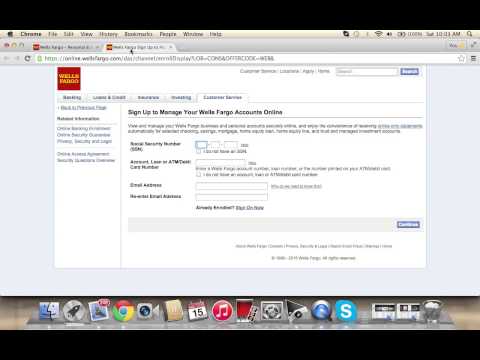

Other software companies realized that there was potential to become the platform of choice for customers to do their banking. Prodigy, owned by Sears, offered a secure network that Wells Fargo and other banks and businesses allowed to access their own company computer systems. Customers using the Prodigy service were able to access their bank accounts from the comfort of home for the first time.

They could also transfer money, read news, play games, and even order groceries online using the community bulletin feature. Customers had to buy a software package and pay a monthly fee for their software's subscription in addition to any fees charged by their bank. Customers had to use floppy disks and dial up modems to connect to their information. Wells Fargo started offering online account access through Prodigy in 1989, and by the mid-1990s it found that only about 10,000 of its 3.5 million customers used the service. A key part of Wells Fargo's business strategy is cross-selling, the practice of encouraging existing customers to buy additional banking services. Customers inquiring about their checking account balance may be pitched mortgage deals and mortgage holders may be pitched credit card offers in an attempt to increase the customer's profitability to the bank.

Other banks have attempted to emulate Wells Fargo's cross-selling practices . As a trusted neighborhood bank, Sterling Bank & Trust provides a comprehensive choice of banking solutions, innovative loan products and outstanding personal service to individuals, professionals, businesses and commercial customers. We're known for highly competitive deposit rates, expertise in mortgage lending and keeping deposits at work in the local community. Our customers know that they can stop by any branch and be treated like family. Since the Bank was founded in 1984, our customers have trusted us to help them handle their banking and financial needs.

Customers looking for a well-established and well-rounded financial institution may do well with Wells Fargo. Not only does this bank possess a large geographic footprint, but it also has every type of account, product and service you may need — a true one-stop banking shop. Add in the fact that you can enjoy some relationship bonuses for linking multiple accounts or products under the Wells Fargo umbrella and this institution is a clear winner for anyone who values efficiency and streamlined banking experience. That said, Wells Fargo has not yet earned back the public's trust after the revelations from 2016 to 2018, of a series of systemic fraudulent practices that victimized its own clients for nearly two decades. In September 2016, Wells Fargo was issued a combined total of $185 million in fines for opening over 1.5 million checking and savings accounts and 500,000 credit cards on behalf of customers without their consent. The Consumer Financial Protection Bureau issued $100 million in fines, the largest in the agency's five-year history, along with $50 million in fines from the City and County of Los Angeles, and $35 million in fines from the Office of Comptroller of the Currency.

The scandal was caused by an incentive-compensation program for employees to create new accounts. It led to the firing of nearly 5,300 employees and $5 million being set aside for customer refunds on fees for accounts the customers never wanted. Carrie Tolstedt, who headed the department, retired in July 2016 and received $124.6 million in stock, options, and restricted Wells Fargo shares as a retirement package. Wells Fargo & Company operates as a diversified financial services. The Company provides banking, insurance, investments, mortgage, leasing, credit cards, and consumer finance.

Wells Fargo & Company serves physical stores, internet, and other distribution channels worldwide. Wells Fargo also touts the use of your Way2Save account as a method of overdraft protection for customers who also have checking accounts. If you sign up for this optional service, Wells Fargo will transfer money from your Way2Save account into your checking account to cover an overdraft. However, this service doesn't prevent you from being charged a $12.50 overdraft fee once per business day. The fee can be avoided if a covering transfer or deposit is made on the same business day.

For purposes of reporting Number of Employees, sole proprietors, self-employed individuals, and independent contractors should include themselves as employees (i.e., the minimum number in the box Number of Employees is one). Borrowers may use their average employment over the time period used to calculate their aggregate payroll costs to determine their number of employees. Alternatively, borrowers may elect to use the average number of employees per pay period in the 12 completed calendar months prior to the date of the loan application.

Divorcing Wall Street-centric work — which can include managing investment funds and providing financial market sales and trading services — from the bank would ensure that Wells Fargo's everyday customers did not continue to suffer, Ms. Warren wrote. The Fed could accomplish this, she explained, by revoking Wells Fargo's financial holding company license — essentially making it impossible for the company to operate any nonbanking businesses. Wells Fargo has struggled to open as many new accounts in the wake of the scandal and without sales goals. The bank said new customer checking account openings plunged by 41% in November compared with the same period of 2015. Another savings encouragement is the Save As You Go® transfer, which moves $1 from your Wells Fargo checking account to your Way2Save account with each qualifying transaction. These transactions include any non-recurring debit card purchases and any time you pay a bill using the Wells Fargo online bill pay option.

East West Bank is a full-service commercial bank serving consumers and businesses throughout the U.S. and in Greater China. For businesses, we offer a complete line of products and services, in addition to an experienced staff that is committed to helping their customers' enterprises succeed. We provide the important financial link that can turn opportunities into growth and prosperity. In 1962, Cathay Bank opened for business with the mission of providing financial services to the growing but underserved Chinese-American community. Cathay Bank, with years of history and experience, is committed to providing a broad spectrum of personal and commercial financial services.in the greater Los Angeles area, thus becoming the first Chinese-American bank in Southern California.

Wells Fargo's digital team wasn't content with having made history developing a new way to bank. It wanted to create a place where customers could manage all aspects of their financial lives. Some ideas, like offering horoscopes and used car sales alongside account histories ended quickly with little enthusiasm. Others, like merging all online accounts into one portal with one log in and mobile banking created meaningful improvements to people's lives. In August 2020, the company agreed to pay $7.8 million in back wages for allegedly discriminating against 34,193 African Americans in hiring for tellers, personal bankers, customer sales and service representatives, and administrative support positions. The company agreed to provide jobs to 580 of the affected applicants.

Elizabeth Magner, a federal bankruptcy judge in the Eastern District of Louisiana, cited the bank's behavior as "highly reprehensible", stating that Wells Fargo has taken advantage of borrowers who rely on the bank's accurate calculations. Wells Fargo & Company is an American multinational financial services company with corporate headquarters in San Francisco, California, operational headquarters in Manhattan, and managerial offices throughout the United States and internationally. The company has operations in 35 countries with over 70 million customers globally. It is considered a systemically important financial institution by the Financial Stability Board.

If you have employees and you are including employee compensation in your loan amount calculation, you must provide payroll documents supporting the employee compensation amount. If you are including owner compensation in your loan amount calculation, you must provide IRS Form 1040 Schedule C. Per SBA guidance, IRS Form 1099 cannot be used to support the loan amount calculation . If using 2020 to calculate loan amount, this is required regardless of whether you filed a 2020 tax return with the IRS. Please be sure to submit necessary documents shown in the chart below, listed by entity type.

This will help ensure that you include documents that support the loan amount you are requesting and to demonstrate that you meet eligibility requirements. The documents you submit must correspond to the time period you use to calculate your maximum loan amount. The latest round of PPP loan funding provides separate eligibility requirements for First Draw PPP Loan customers vs. Second Draw PPP Loan customers. The SBA eligibility requirements of the PPP program are comprehensive and cover borrower characteristics such as number of employees, type of industry, date of operation, qualifying payroll cost or self-employed compensation, and other requirements. Applicants are responsible for understanding the PPP eligibility requirements and providing accurate information on the PPP loan application. For more information about PPP loan eligibility requirements, please visit the SBA PPP site.

New student loans and student loan refinancing are no longer available from Wells Fargo. Contact your school's financial aid office to consider other options. There you can find resources and information regarding scholarships, grants, and federal student aid. In addition, your school will likely have information regarding other lenders that work with your school to provide private student loans.

After your student loan is transferred, your student loan will no longer appear on Wells Fargo Online®. If your student loan is your only account with Wells Fargo, you will no longer have access to Well Fargo Online after this transfer is complete. Firstmark Services will mail you written instructions describing how to set up online access using your new account number. After your student loan is transferred, your student loan will no longer appear on Wells Fargo Online. Direct Express ® will never contact you by phone, email or text message to ask you for your card number, password, PIN or security code.

If you have responded to any communication asking you to provide any card or personal information, please inform Direct Express ® customer service immediately by calling the number on the back of your card. In a letter to Fed Chair Jerome Powell, the Massachusetts Democrat called on the central bank's board of governors to use its authority to separate Wells Fargo's banking unit from its financial services businesses. She said the Fed could break up Wells Fargo by revoking its license to operate as a financial holding company. Wells Fargo is the country's fourth-largest bank, though its Wall Street presence — including investment banking and wealth management services — is much smaller than those of competitors like JPMorgan Chase and Bank of America. Its chief executive, Charles W. Scharf, has a Wall Street background and, since taking over two years ago, has tried to make Wells Fargo more profitable by steering it more toward Wall Street.

The Fed has already taken drastic measures to try to force Wells Fargo to improve. Since early 2018, the bank has been operating under an asset cap, which the Fed vowed to keep in place until the bank could prove it had overhauled its risk-management procedures and established better protections for its customers. But Ms. Warren said the bank was distracted from that goal, citing reports that Wells Fargo was trying to expand activities like putting together corporate mergers and other investment banking services.

In a letter to the Federal Reserve chair, Jerome H. Powell, on Monday, Ms. Warren asked the Fed to force the financial giant to break off its core banking activities, like offering checking and savings accounts and loans, from its other financial services. Early computers filled entire rooms and required a dedicated team of skilled programmers to operate. By the 1980s, computers had shrunk to fit on most desks, and had evolved to become more user friendly.

In California, almost 36% of people used a computer at work or home by 1989. Realizing that banking customers would start to expect their account access to extend online as well as in-person, banks started to experiment with new technologies to make banking online at home possible. Secured software on floppy disks offered some of the earliest solutions, but encrypted web-based platforms had the lasting legacy and are still used by customers today. Wells Fargo & Company is a diversified financial services company with $1.3 trillion assets providing banking, insurance, and investments. Wells Fargo coined the phrase, "Go for Gr-Eight" – or, in other words, aim to sell at least 8 products to every customer.

The board chose to use a clawback clause in the retirement contracts of Stumpf and Tolstedt to recover $75 million worth of cash and stock from the former executives. On October 12, 2016, John Stumpf, the then chairman and CEO, announced that he would be retiring amidst the scandals. President and Chief Operating Officer Timothy J. Sloan succeeded Stumpf, effective immediately. Following the scandal, applications for credit cards and checking accounts at the bank plummeted. In response to the event, the Better Business Bureau dropped accreditation of the bank.

Several states and cities ended business relations with the company. In February 2015, Wells Fargo agreed to pay $4 million, including a $2 million penalty and $2 million in restitution for illegally taking an interest in the homes of borrowers in exchange for opening credit card accounts for the homeowners. Double-check the dates of the documents you submit in support of your loan application (e.g. 2019 or 2020) to ensure they match the time period you are using as the basis to calculate your maximum loan amount. For example, if you select the time period calendar year 2020 in the application, please make sure your supporting documents align to the year 2020 only. As business owners like you continue to feel the impact of these unprecedented times, we're here to help. We're proud to have served more than 200,000 customers already with Paycheck Protection Program loans.

Eighty-four percent of our PPP customers had fewer than 10 employees, and our average loan amount of $54,000 was the lowest among all of the participating large banks, showing our commitment to helping the smallest businesses in need. After your student loan has transferred to Firstmark Services, payments should be sent to Firstmark Services. After this transfer, any payments made to Wells Fargo Education Financial Services will be transferred to Firstmark Services for processing for 120 days from your transfer date. After that 120-day period has passed, payments will no longer be accepted by Wells Fargo and any payments received will be returned. With Zelle people have been scammed not only as buyers, but also as sellers.

If you don't, chances are slim that any bank or law enforcement authority is going to help you. The Zelle app allows you to add people's name, email address, and mobile phone number. We're happy to help answer any questions you have about our prepaid products & financial services. American Veterans Group, PBC, is a military veteran-owned, social impact-focused broker dealer that delivers value to institutional clients while providing meaningful philanthropic support to the military veteran community. The company reinvests 25% of its earnings in national and local military veteran non-profit organizations that provide worthy services and support to one of America's most vulnerable, at-risk populations.

As Wall Street's only public benefit corporation, American Veterans Group empowers institutional clients to partner in its social mission while enabling them to remain focused on key business objectives and goals. To learn more about American Veterans Group, visit their website at We sell different types of products and services to both investment professionals and individual investors.

These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. Last week, federal regulators announced another set of fines and restrictions on the bank, stemming from its inappropriate handling of some of its home loan customers' portfolios. The Office of the Comptroller of the Currency found that Wells Fargo's management of its mortgage accounts had been so sloppy that it might have improperly foreclosed on some borrowers' homes. The regulator fined the bank $250 million, ordered it to halt some foreclosures in progress and gave it five months to get its management systems on track.

Once you are set up with a Wells Fargo account, you can take care of your banking needs online and with the mobile app. As the bank's premium checking account, Portfolio by Wells Fargo offers customers a number of major perks. At its core, the Portfolio account is an interest-bearing checking account, although the 0.01% APY is not currently impressive.

Expect a $25 per month maintenance fee, unless you maintain a minimum of $20,000 in your linked accounts at the end of each statement period. While it is relatively easy to avoid the monthly fee, make sure you're aware of the other charges you may face, including a $2.50 out-of-network ATM fee and a $35 overdraft fee if you overdraw your account. If you sign up for Overdraft Protection with a linked savings account, you can avoid the painful $35 fee, but you will still have to pony up a $12.50 transfer fee when the money moves from savings to checking. In addition, Wells Fargo automatically waives the monthly fee for account holders under the age of 24. Enjoy banking convenience with your FIU One Card when it's linked to a Wells Fargo Everyday Checking account. Take advantage of this optional benefit today to enjoy added savings on fees and transactions, easy ATM access, and helpful online financial educational resources and money management tools.

From December 2012 through February 2018, Wells Fargo reportedly helped two of the biggest firearms and ammunition companies obtain $431.1 million in loans. It also handled banking for the National Rifle Association and provided bank accounts and a $28-million line of credit. In 2020, the company said that it is winding down its business with the National Rifle Association. On February 9, 2012, it was announced that the five largest mortgage servicers agreed to a settlement with the US Federal Government and 49 states. The settlement, known as the National Mortgage Settlement , required the servicers to provide about $26 billion in relief to distressed homeowners and in direct payments to the federal and state governments. This settlement amount makes the NMS the second largest civil settlement in U.S. history, only trailing the Tobacco Master Settlement Agreement.

The five banks were also required to comply with 305 new mortgage servicing standards. The firm's primary subsidiary is Wells Fargo Bank, N.A., a national bank chartered in Wilmington, Delaware which designates its main office in Sioux Falls, South Dakota. It is the fourth largest bank in the United States by total assets and is one of the largest as ranked by bank deposits and market capitalization. Along with JPMorgan Chase, Bank of America, and Citigroup, Wells Fargo is one of the "Big Four Banks" of the United States.

If you are using payroll documents to substantiate your loan amount, third-party payroll documents are acceptable. Examples include CARES SBA –PPP, ADP® Payroll, GustoTM Payroll, or Paychex® Payroll Reports. If you don't have third party payroll documents, you may provide other documents, such as tax documents. Student loan interest is interest and eligible fees you paid during the year on a qualified student loan. The amount provided to you on your Form 1098-E is a reflection of the amount of interest that has been paid during the year on qualified student loans. Zelle® is a fast, safe and easy way to send and receive money directly between almost any bank accounts in the U.S., typically within minutes.